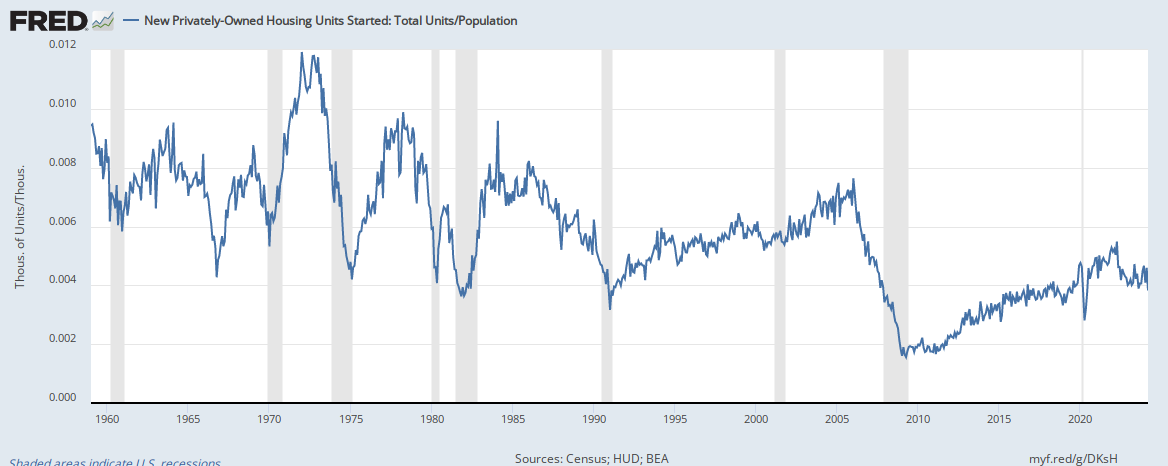

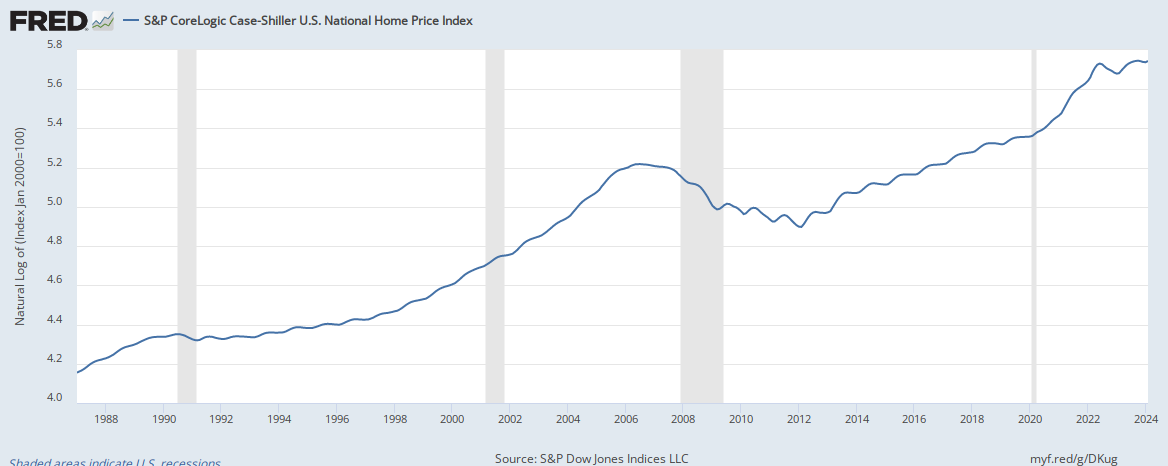

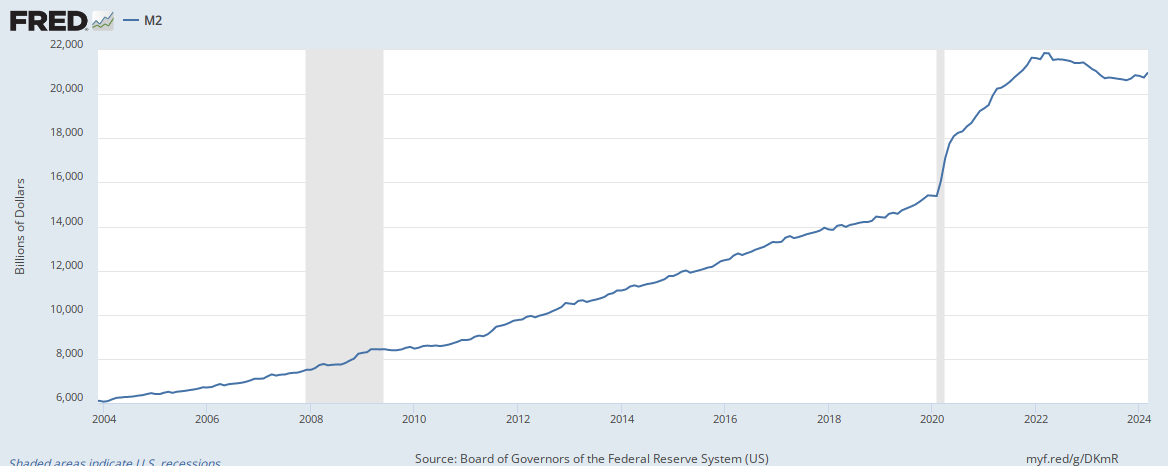

How can we not be headed for big time inflation? I’m too young to remember the Carter era and we really haven’t had inflation in my lifetime. However, with the number of dollars being put into the economy, the singular focus on reducing unemployment, and a ramp up of the economy that already has too many dollars chasing too few goods, it seems inevitable. Anecdotally there are examples all over the place from housing to lumber to used cars. I think the current crypto craze is being fueled by it as people try to find a place to park excess dollars. There have been fears of inflation in the last 20 years but it has never come to pass. Is this time different?

Colleges

- AAC

- ACC

- Big 12

- Big East

- Big Ten

- Pac-12

- SEC

- Atlantic 10

- Conference USA

- Independents

- Junior College

- Mountain West

- Sun Belt

- MAC

- More

- Navy

- UAB

- Tulsa

- UTSA

- Charlotte

- Florida Atlantic

- Temple

- Rice

- East Carolina

- USF

- SMU

- North Texas

- Tulane

- Memphis

- Miami

- Louisville

- Virginia

- Syracuse

- Wake Forest

- Duke

- Boston College

- Virginia Tech

- Georgia Tech

- Pittsburgh

- North Carolina

- North Carolina State

- Clemson

- Florida State

- Cincinnati

- BYU

- Houston

- Iowa State

- Kansas State

- Kansas

- Texas

- Oklahoma State

- TCU

- Texas Tech

- Baylor

- Oklahoma

- UCF

- West Virginia

- Wisconsin

- Penn State

- Ohio State

- Purdue

- Minnesota

- Iowa

- Nebraska

- Illinois

- Indiana

- Rutgers

- Michigan State

- Maryland

- Michigan

- Northwestern

- Arizona State

- Oregon State

- UCLA

- Colorado

- Stanford

- Oregon

- Arizona

- California

- Washington

- USC

- Utah

- Washington State

- Texas A&M

- Auburn

- Mississippi State

- Kentucky

- South Carolina

- Arkansas

- Florida

- Missouri

- Ole Miss

- Alabama

- LSU

- Georgia

- Vanderbilt

- Tennessee

- Louisiana Tech

- New Mexico State

- Middle Tennessee

- Western Kentucky

- UTEP

- Florida International University

High School

- West

- Midwest

- Northeast

- Southeast

- Other

- Alaska

- Arizona

- California

- Colorado

- Nevada

- New Mexico

- Northern California

- Oregon

- Southern California Preps

- Washington

- Edgy Tim

- Indiana

- Kansas

- Nebraska

- Iowa

- Michigan

- Minnesota

- Missouri

- Oklahoma Varsity

- Texas Basketball

- Texas

- Wisconsin

- Delaware

- Maryland

- New Jersey Basketball

- New Jersey

- New York City Basketball

- Ohio

- Pennsylvania

- Greater Cincinnati

- Virginia

- West Virginia Preps

ADVERTISEMENT

Install the app

How to install the app on iOS

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Inflation

- Thread starter NeekReevers

- Start date

If you can make sense out of this please explain it to me. I don’t understand a bit of it.How can we not be headed for big time inflation? I’m too young to remember the Carter era and we really haven’t had inflation in my lifetime. However, with the number of dollars being put into the economy, the singular focus on reducing unemployment, and a ramp up of the economy that already has too many dollars chasing too few goods, it seems inevitable. Anecdotally there are examples all over the place from housing to lumber to used cars. I think the current crypto craze is being fueled by it as people try to find a place to park excess dollars. There have been fears of inflation in the last 20 years but it has never come to pass. Is this time different?

The Hockey Stick Rise in M1 is a Monetary Statistical Mirage

Huge Monetary Risk Earlier today I posed a Q&A what if on QE: What Would Happen to Inflation If the Fed Announced $40 Trillion a Month in QE? My conclusion was

mishtalk.com

mishtalk.com

I might add that in the last three weeks I have been informed by every single vendor I use that they are raising their prices effective June 1.If you can make sense out of this please explain it to me. I don’t understand a bit of it.

The Hockey Stick Rise in M1 is a Monetary Statistical Mirage

Huge Monetary Risk Earlier today I posed a Q&A what if on QE: What Would Happen to Inflation If the Fed Announced $40 Trillion a Month in QE? My conclusion wasmishtalk.com

How can we not be headed for big time inflation? I’m too young to remember the Carter era and we really haven’t had inflation in my lifetime. However, with the number of dollars being put into the economy, the singular focus on reducing unemployment, and a ramp up of the economy that already has too many dollars chasing too few goods, it seems inevitable. Anecdotally there are examples all over the place from housing to lumber to used cars. I think the current crypto craze is being fueled by it as people try to find a place to park excess dollars. There have been fears of inflation in the last 20 years but it has never come to pass. Is this time different?

Supposedly employers can't find employees, and it makes me wonder about a correlation.

@07pilt makes the case for unlimited spending, basically because we're the printer and banker and what's anybody gonna do about it? (I just molested his position, but that's kind of close). I like Pilt. I enjoy Pilt. My initial intuition was that his view of this is a bit cavalier and eventually causes inflation and potential monetary collapse, but he makes a point. I can't help but wonder if we start seeing some crazy inflation with all this spending.

SOme inflation is good though, and you'd think some downward price pressure in building material pricing would have to occur once full production resumes after the COVID shutdown.

Good question, Whari. This shows inflationing.What is inflation?

no really, what is the definition?

An increase in the money supply relative to goods for purchase.no really, what is the definition?

no really, what is the definition?

You can go to www.google.com and enter "inflation" and it will bring up definitions for you.

You can go to www.google.com and enter "inflation" and it will bring up definitions for you.

I want your stupid version obviously. Why do you make me break character by being so obtuse?

wrongAn increase in the money supply relative to goods for purchase.

An increase in the money supply relative to goods for purchase.

so we have had an increase in money supply several times since 2008. What am I missing?

I want your stupid version obviously. Why do you make me break character by being so obtuse?

You idiot. Participate or don't but don't act like effin' Flailey.

You idiot. Participate or don't but don't act like effin' Flailey.

I love it when you get over your skis.

As opposed to what, no increase in money supply over a 13 year period?so we have had an increase in money supply several times since 2008.

As opposed to what, no increase in money supply over a 13 year period?

we were supposed to be having inflation this whole time according to the Econ books.

Quit being gratuitously adversarial and thick and slow.I love it when you get over your skis.

we were supposed to be having inflation this whole time according to the Econ books.

Well, yeah. And we have. What's your point?

Well, yeah. And we have. What's your point?

Do increases in the money supply cause or accelerate inflation? - Thoughtful Finance

Do increases in the money supply cause or accelerate inflation? Let’s consider the evidence… First, a chart of the annualized percentage changes in the money supply (M1) and consumer price index (CPI). We can also look at the same data, but use the absolute value of the money supply. Again...

thoughtfulfinance.com

Let’s say a widget costs $1.00, and so does a Thingamajig. If the money supply is increased so that both the widget and thingamajig now cost $2.00, the comparative value of the widget and thingamajig remain the same, but the relative value of the dollar to those items has inflated, it takes more dollars to purchase either one. The money has been devalued relative to the items it is used to purchase. Inflation is the increase of the money supply relative to the goods.so we have had an increase in money supply several times since 2008. What am I missing?

Inflation has been relatively low because the money supply has not been increased significantly compared to the total value of goods it can purchase. As the money supply has increased so has the supply of goods.

you need to call it what it is...same $wshit higher price.Let’s say a widget costs $1.00, and so does a Thingamajig. If the money supply is increased so that both the widget and thingamajig now cost $2.00, the comparative value of the widget and thingamajig remain the same, but the relative value of the dollar to those items has inflated, it takes more dollars to purchase either one. The money has been devalued relative to the items it is used to purchase. Inflation is the increase of the money supply relative to the goods.

Inflation has been relatively low because the money supply has not been increased significantly compared to the total value of goods it can purchase. As the money supply has increased so has the supply of goods.

???Inflation has been relatively low because the money supply has not been increased significantly compared to the total value of goods it can purchase. As the money supply has increased so has the supply of goods.

The simplest way I have had the cause of inflation explained to me is too many dollars chasing too few goods and services. There has definitely been a massive increase in the number of dollars, but as PD stated earlier we’ve not recently had a shortage of goods and services. With companies coming out of COVID reductions, and a portion of the labor force being incentivized to not go back to work, will supply be able to meet demand? 20% of all dollars in circulation were printed in 2020. Is that a lot? It seems like a lot.

Do increases in the money supply cause or accelerate inflation? - Thoughtful Finance

Do increases in the money supply cause or accelerate inflation? Let’s consider the evidence… First, a chart of the annualized percentage changes in the money supply (M1) and consumer price index (CPI). We can also look at the same data, but use the absolute value of the money supply. Again...thoughtfulfinance.com

Dan, why is whari's chart not showing some relationship between money supply and consumer prices? Anywhere?Let’s say a widget costs $1.00, and so does a Thingamajig. If the money supply is increased so that both the widget and thingamajig now cost $2.00, the comparative value of the widget and thingamajig remain the same, but the relative value of the dollar to those items has inflated, it takes more dollars to purchase either one. The money has been devalued relative to the items it is used to purchase. Inflation is the increase of the money supply relative to the goods.

Inflation has been relatively low because the money supply has not been increased significantly compared to the total value of goods it can purchase. As the money supply has increased so has the supply of goods.

Let’s say a widget costs $1.00, and so does a Thingamajig. If the money supply is increased so that both the widget and thingamajig now cost $2.00, the comparative value of the widget and thingamajig remain the same, but the relative value of the dollar to those items has inflated, it takes more dollars to purchase either one. The money has been devalued relative to the items it is used to purchase. Inflation is the increase of the money supply relative to the goods.

Inflation has been relatively low because the money supply has not been increased significantly compared to the total value of goods it can purchase. As the money supply has increased so has the supply of goods.

Its not the supply of money that matters, its the velocity of money.

Inflation happens when demand outstrips supply. Prices go up until the buying power of people's money equals the supply of goods and services available. If the government prints money but it just goes to plug wholes in people's balance sheets, that doesn't create inflation. If the government prints money but it sits on the balance sheets of banks, that doesn't create inflation. If the government prints money and people use it to buy things, but not more things than can be made, that is doesn't cause inflation. If unemployment is 6% and job growth is only 250,000 per month, I can assure you that inflation is not just around the corner.

I'm not; my first mortgage was 16 7/8% with a builder buydown to 12 7/8's.I’m too young to remember the Carter era

Take a look at the housing market right now. Then tell me inflation isn't happening. It's already here.

Take a look at the housing market right now. Then tell me inflation isn't happening. It's already here.

We're behind the rest of the country. It's been going on for years elsewhere. This is just coastal and Texas money moving into Oklahoma.

Yes the only thing that changes prices is inflation.Take a look at the housing market right now. Then tell me inflation isn't happening. It's already here.

When oil traded at $-20 we were in the midst of world ending deflation too.

This is an unique economic situation in that the price increases are largely a product of a shortage of supply not an increase in demand as a result of the drop in production in many "non-essential" industries do to covid. As production gears back up those shortages should fade over the next twelve months. Its difficult to tell what that means long term as far as prices.

Not really comparable to the 70s in a number of areas. The 70s inflation was a decade long run starting in the Nixon years. Inflation was coupled with skyrocking interest rates in the late 70s stalling the economy. Just the opposite of today when cheap money is driving the housing market.

Not sure what all this means overall. Certainly short term inflation on some key goods but I'm doubtful you're see the kind of long term run you saw in the 70s.

Not really comparable to the 70s in a number of areas. The 70s inflation was a decade long run starting in the Nixon years. Inflation was coupled with skyrocking interest rates in the late 70s stalling the economy. Just the opposite of today when cheap money is driving the housing market.

Not sure what all this means overall. Certainly short term inflation on some key goods but I'm doubtful you're see the kind of long term run you saw in the 70s.

I think it is appropriate to say inflation is the devaluation of money. If the money supply and the supply of goods remain stable, or rise or fall proportionately, there is no inflation. If the demand for a widget outstrips the supply of widgets, but the money supply remains basically the same, and the supply of all other goods remains the same, there will be a price increase on widgets, but that would not be inflation. The tension on the price of all other goods would be minimal. The rate of employment has little to ne bearing on inflation. There can be inflation only when there is more money than goods.Inflation happens when demand outstrips supply. Prices go up until the buying power of people's money equals the supply of goods and services available. If the government prints money but it just goes to plug wholes in people's balance sheets, that doesn't create inflation. If the government prints money but it sits on the balance sheets of banks, that doesn't create inflation. If the government prints money and people use it to buy things, but not more things than can be made, that is doesn't cause inflation. If unemployment is 6% and job growth is only 250,000 per month, I can assure you that inflation is not just around the corner.

As measured by the general price levels for goods and services, yes.I think it is appropriate to say inflation is the devaluation of money.

Dan this is empirically false. Money supply does not equal demand. See HighStickHarry's chart.If the money supply and the supply of goods remain stable, or rise or fall proportionately, there is no inflation.

You are correct, the change in demand for individual goods isn't a determinant of inflation, its the change in aggregate demand.If the demand for a widget outstrips the supply of widgets, but the money supply remains basically the same, and the supply of all other goods remains the same, there will be a price increase on widgets, but that would not be inflation. The tension on the price of all other goods would be minimal.

False. If there is high employment there is spare productive capacity that can increase the supply levels to match demand.The rate of employment has little to ne bearing on inflation.

Dan, flesh this out. In your statement money is what? Total number of green backs in circulation? Does it include money under my mattress? Does it include money in my savings account? Does it include money in my line of credit? What are goods in this scenario? The totality of all land, property, objects that exist? Where do services come in? How can the supply of money measured in dollars be compared to the supply of goods measured in acres, office space square feet, feet of lumber, tons of concrete, yards of fabric? If you can think about how these things are measured and compared it can lead you to the right conclusions on inflation.There can be inflation only when there is more money than goods.

Good grief, Pilt, you're asking for a thesis! Money is the medium of exchange. In this case I'm talking about the fiat dollars that are printed by the government. So, yes, it includes existing money under your mattress, ready to be spent on a moment's notice. Yes, it includes money in your savings account, dollars that can be withdrawn from your account and spent at any time. Yes, it includes your line of credit, because your line of credit is held by the creditor and is issued to you as dollars upon demand.As measured by the general price levels for goods and services, yes.

Dan this is empirically false. Money supply does not equal demand. See HighStickHarry's chart.

You are correct, the change in demand for individual goods isn't a determinant of inflation, its the change in aggregate demand.

False. If there is high employment there is spare productive capacity that can increase the supply levels to match demand.

Dan, flesh this out. In your statement money is what? Total number of green backs in circulation? Does it include money under my mattress? Does it include money in my savings account? Does it include money in my line of credit? What are goods in this scenario? The totality of all land, property, objects that exist? Where do services come in? How can the supply of money measured in dollars be compared to the supply of goods measured in acres, office space square feet, feet of lumber, tons of concrete, yards of fabric? If you can think about how these things are measured and compared it can lead you to the right conclusions on inflation.

Goods are those things which exist that are for trade (sale). They include products on shelves, acres, office space, services, pretty much anything on which the money can be spent. Those goods and services are valued by the sellers and buyers. There is normally a limited supply of goods and services, and it is up to the issuer of the fiat currency to determine how much money to issue in order to keep things stable, and how much money is already in circulation. It is a hell of an undertaking and it surprises the hell out of me how well it has worked in general.

Spot on. In certain classes the recovery in supply will take longer as projected demand was already gapping relative to realized demand. Think semiconductors - the time to build new capacity, especially given the process innovations that require essentially new plants be built, was already lagging demand and Covid has had an inverse impact goosing demand while making new capacity even harder/longer to bring on line. 24 months IMO before we see any sort of equilibrium in that market which is only really possible if bigger consumers of those parts don't tie up production through strategic investments. The smart money is pumping into efficiency optimization plays IMO.This is an unique economic situation in that the price increases are largely a product of a shortage of supply not an increase in demand as a result of the drop in production in many "non-essential" industries do to covid. As production gears back up those shortages should fade over the next twelve months. Its difficult to tell what that means long term as far as prices.

Not really comparable to the 70s in a number of areas. The 70s inflation was a decade long run starting in the Nixon years. Inflation was coupled with skyrocking interest rates in the late 70s stalling the economy. Just the opposite of today when cheap money is driving the housing market.

Not sure what all this means overall. Certainly short term inflation on some key goods but I'm doubtful you're see the kind of long term run you saw in the 70s.

Pilt, I have wanted to read this book for a long time. The problem is I’m not educated on monetary policy (as I’m sure you can tell!) and this book intimidates the hell out of me that I’ll be lost within two pages. Have you read it? I won’t ask for a review because I suspect you disagree from cover to cover. But I’m wondering if you think an uneducated layman such as myself would understand what he’s saying?As measured by the general price levels for goods and services, yes.

Dan this is empirically false. Money supply does not equal demand. See HighStickHarry's chart.

You are correct, the change in demand for individual goods isn't a determinant of inflation, its the change in aggregate demand.

False. If there is high employment there is spare productive capacity that can increase the supply levels to match demand.

Dan, flesh this out. In your statement money is what? Total number of green backs in circulation? Does it include money under my mattress? Does it include money in my savings account? Does it include money in my line of credit? What are goods in this scenario? The totality of all land, property, objects that exist? Where do services come in? How can the supply of money measured in dollars be compared to the supply of goods measured in acres, office space square feet, feet of lumber, tons of concrete, yards of fabric? If you can think about how these things are measured and compared it can lead you to the right conclusions on inflation.

So the key is not the stock of money it is the flow. Money that isn't getting spent doesn't bid up prices. Dollars per unit of time.Good grief, Pilt, you're asking for a thesis! Money is the medium of exchange. In this case I'm talking about the fiat dollars that are printed by the government. So, yes, it includes existing money under your mattress, ready to be spent on a moment's notice. Yes, it includes money in your savings account, dollars that can be withdrawn from your account and spent at any time. Yes, it includes your line of credit, because your line of credit is held by the creditor and is issued to you as dollars upon demand.

So because we can't compare the quantity of goods/services directly to the quantity of money we have to measure things differently. This month at last month's prices what is the value of the goods and services that changed hands. Now compare that to the amount of money spent last month (Dollars per month) and you can actually compare the quantities. You'll notice that what we are actually talking about is supply and demand. how many goods changed hands last month and at what price.Goods are those things which exist that are for trade (sale). They include products on shelves, acres, office space, services, pretty much anything on which the money can be spent. Those goods and services are valued by the sellers and buyers. There is normally a limited supply of goods and services, and it is up to the issuer of the fiat currency to determine how much money to issue in order to keep things stable, and how much money is already in circulation. It is a hell of an undertaking and it surprises the hell out of me how well it has worked in general.

Similar threads

- Replies

- 64

- Views

- 853

- Replies

- 63

- Views

- 2K

- Replies

- 2

- Views

- 386

- Replies

- 1

- Views

- 164

ADVERTISEMENT

Latest posts

-

-

Canton Ohio Black Man dies while handcuffed on floor. Here we go again

- Latest: iasooner2000

-

-

-

ADVERTISEMENT