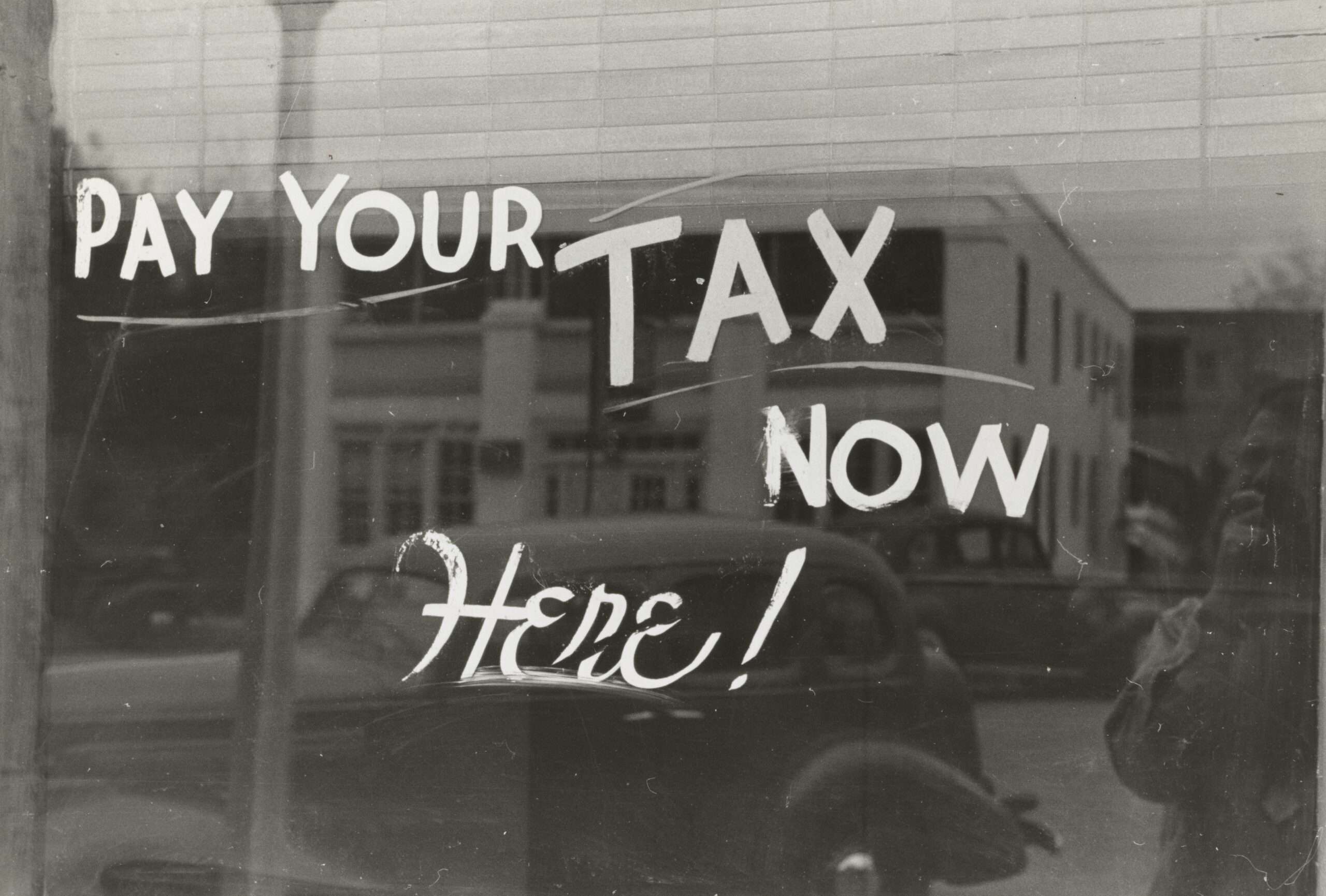

Americans spent more on taxes last year than on food, health care, education, and clothing combined

Overall, taxes accounted for about 25 percent of average consumer spending.

Sobering.

Follow along with the video below to see how to install our site as a web app on your home screen.

Note: This feature may not be available in some browsers.

Given the distribution of tax burden I suspect this is true in aggregate but not in reality for the vast majority of Americans.

Americans spent more on taxes last year than on food, health care, education, and clothing combined

Overall, taxes accounted for about 25 percent of average consumer spending.reason.com

Sobering.

Given the distribution of tax burden I suspect this is true in aggregate but not in reality for the vast majority of Americans.

Sounds like a liberal utopia but I don't see where they mention Unicorns.Maybe its time to give more?

By Eric Fruits, Ph.D.

This year, Oregon passed a major milestone. In 2020, Portland became the city with the highest personal income taxes in the United States.

The news was delivered this week in testimony to the Oregon Legislature. The State Tax Research Institute reported that state and local income taxes in Portland total nearly 14% — a rate that’s higher than San Francisco or New York.

That means the average Portland resident must work almost two months just to pay their state and local taxes.

Are we getting our money’s worth? It sure doesn’t seem like it.

Now that we have record shattering tax rates, it’s time for us to ask: When will we get our money’s worth?

- Do we have great schools? No. We have the fifth worst graduation rate in the country.

- Do we have flourishing businesses? No. Over the past few years it seems more businesses are leaving than arriving.

- A lot of our taxes go to the Oregon Health Plan. Do we have great health care? According to U.S. News and World Report, our state ranks near the bottom in adult and child wellness visits as well as child dental visits.

Thank goodness David lives in a quaint walled-in country club suburb of Portland and has skillfully avoided those high taxes. Is it possible that once he retreats to the country his taxes will go even lower? He doesn't charge $400/hour for his analyses for nothing!Maybe its time to give more?

By Eric Fruits, Ph.D.

This year, Oregon passed a major milestone. In 2020, Portland became the city with the highest personal income taxes in the United States.

The news was delivered this week in testimony to the Oregon Legislature. The State Tax Research Institute reported that state and local income taxes in Portland total nearly 14% — a rate that’s higher than San Francisco or New York.

That means the average Portland resident must work almost two months just to pay their state and local taxes.

Are we getting our money’s worth? It sure doesn’t seem like it.

Now that we have record shattering tax rates, it’s time for us to ask: When will we get our money’s worth?

- Do we have great schools? No. We have the fifth worst graduation rate in the country.

- Do we have flourishing businesses? No. Over the past few years it seems more businesses are leaving than arriving.

- A lot of our taxes go to the Oregon Health Plan. Do we have great health care? According to U.S. News and World Report, our state ranks near the bottom in adult and child wellness visits as well as child dental visits.

Need a bus on yer lawn?Given the distribution of tax burden I suspect this is true in aggregate but not in reality for the vast majority of Americans.

I think this must be the closest you’ve ever come to admitting the rich pay more than their fair share. It’s when you say things like this that gives me hope the day will come that the scales fall from your eyes and you realize the error in your statist way of thinking.Given the distribution of tax burden I suspect this is true in aggregate but not in reality for the vast majority of Americans.

Don't hold yer breath. 😉I think this must be the closest you’ve ever come to admitting the rich pay more than their fair share. It’s when you say things like this that gives me hope the day will come that the scales fall from your eyes and you realize the error in your statist way of thinking.

My man this admin is absolutely incredible and embarrassing.

Gotta take care of diaper man's open border. Know what I'm saying?Taxes are theft and for the sheep

You know the story about the federal dollars for Jackson right?

No, none of us know that story, David. We’re sure you’ve done intense research on it, just like you do on every single topic known to man. So why don’t you tell us the story. With your ability to articulate I’m sure it will ge spellbinding. Ready? Set? Go! Tell that story, David!You know the story about the federal dollars for Jackson right?