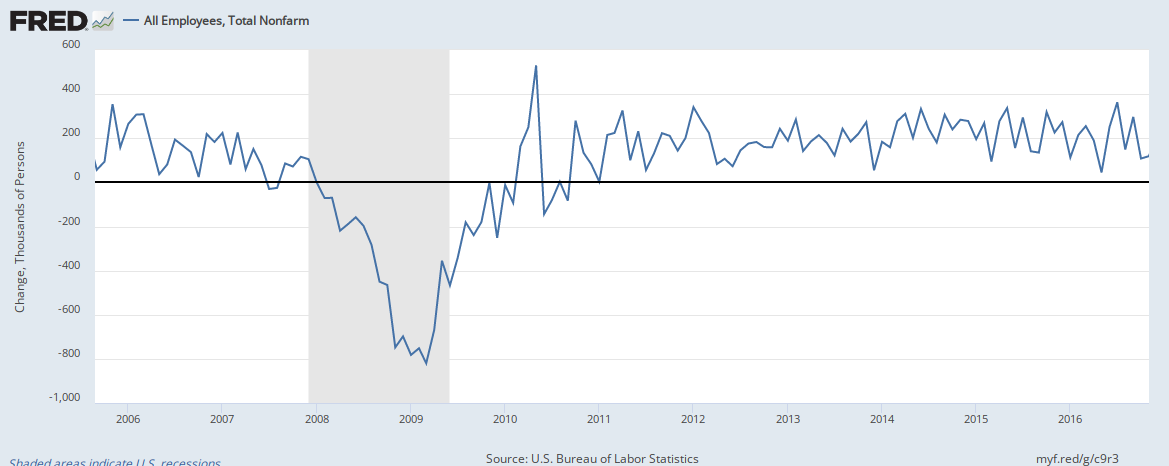

...out of 96 months of Obama's reign. For the first time.

I swear to God, it's not the sketchy bullshit these bureaucratic assholes pull so much as the fact that they obviously expect us to believe it's not politicized establishment uniparty self preservation of the status quo.

I swear to God, it's not the sketchy bullshit these bureaucratic assholes pull so much as the fact that they obviously expect us to believe it's not politicized establishment uniparty self preservation of the status quo.